Tax consultant: Template for an application with resume

You have it under control, numbers and tax laws are your playground, and you are ready for the next career leap as a tax consultant? Then you are in the right place! Are you looking for the best tips for your application as a tax consultant or for hints for a convincing resume? We offer you everything you need for a successful application – from valuable tips for your cover letter to sample templates for your cover letter and resume. Let us support you on your way to a successful career as a tax consultant!

Successful application as a tax consultant: Our tips lead to success

Get inspired by our sample for the cover letter for an application as a tax consultant. This template supports you with suitable phrases for your cover letter in tax consulting. Pay attention to addressing the requirements of the company's job description. Link your previous skills and experiences to the required knowledge and characteristics specified in the job advertisement. It is important that the recruiter recognizes your technical qualification and genuine interest in the open position. This will increase your chances of being invited to an interview.

Dear [Name of Contact Person],

The challenge and diversity of the tax consultancy sector have fascinated me for a long time. Through my comprehensive education and solid professional experience, I have gained valuable insights into the world of taxes which I now aim to contribute actively to [Company Name].

Throughout my career, I have not only sharpened my analytical skills but also acquired extensive knowledge in advising and supporting clients. I particularly value direct contact with clients and the opportunity to offer them tailored solutions to tax issues based on my knowledge and experience.

My work at [Previous Company] has shown me how important precise and forward-thinking work is in tax consultancy. In addition to preparing tax returns and balance sheets, my main tasks included providing tax advice and representing clients in non-contentious and contentious matters. Through these varied activities, I have not only deepened my professional skills but also learned to keep an overview in complex situations and make decisions with precision.

Your advertised position offers me the ideal opportunity to further develop my skills in a targeted manner and actively contribute to the success of your company. I am particularly drawn to the orientation and philosophy of your organization, and I am convinced that with my commitment and expertise, I can be a valuable addition to your team.

I am available for a personal interview at your convenience and look forward to getting to know you and your company better.

Kind regards

[Your Name]

Do you like the template? Feel free to use it as a template for your application as a tax consultant and customize it to your liking. Don't forget to add your personal details and the full address of the recipient, as well as the current date. If you know the name of the contact person, address them directly, for example: Dear Mr. Müller.

Authentic cover letter: Your role with your competencies in focus

You can use the above template for your cover letter as a tax consultant to create a professional and individual application. It is important that you tailor the template to your personal circumstances and qualifications to leave the best possible impression.

- Create annual financial statements: You prepare balance sheets and profit and loss statements for companies.

- Submit tax returns: You prepare tax returns for individuals and companies and submit them on time.

- Conduct tax optimization: You find legal ways to minimize the tax burden of your clients.

- Advise clients: You inform and advise your clients on tax and business-related matters.

- Manage financial accounting: You take care of the accurate recording and management of all business transactions.

- Support audits: You prepare your clients for examinations by the tax office and accompany them.

- Lodge appeals: You represent the interests of your clients in case of tax disputes.

- Attend further training: You constantly educate yourself to stay up to date on the latest tax legislation.

By customizing the template for your cover letter, you demonstrate your dedication and attention to detail. The listed tasks give you an idea of the responsibilities that may come your way in your future job as a tax consultant. Use this information to optimize your cover letter and convince potential employers of your skills.

Also in these industries, you are in demand as a tax advisor

As a tax advisor, you have a variety of opportunities to work in different industries. Your expertise in tax law and business matters makes you a sought-after consultant in various sectors of the economy and public life.

- Financial sector: In banks, insurance companies, and investment firms, you can apply your knowledge in tax law and financial planning.

- Healthcare industry: Here, you advise hospitals, doctors, and other healthcare providers on tax and business matters.

- Real estate industry: You support real estate companies and developers in optimizing the tax aspects of real estate transactions.

- Industry and trade: In large corporations and medium-sized businesses, you are responsible for tax planning and declarations.

- Public administration: You can also work for government institutions and oversee the tax aspects of public projects.

- IT and technology: Here, you assist innovative start-ups and established technology companies with tax structuring and financing.

- Freelancers and small business owners: You support self-employed professionals such as lawyers, architects, and artisans with their tax matters.

As you can see, there are numerous industries where you can work as a tax advisor. Each industry has its own challenges and requirements, but with your expertise, you can make valuable contributions everywhere. Whether in the financial sector, healthcare industry, or real estate sector - your skills are in demand and open up many exciting career opportunities for you.

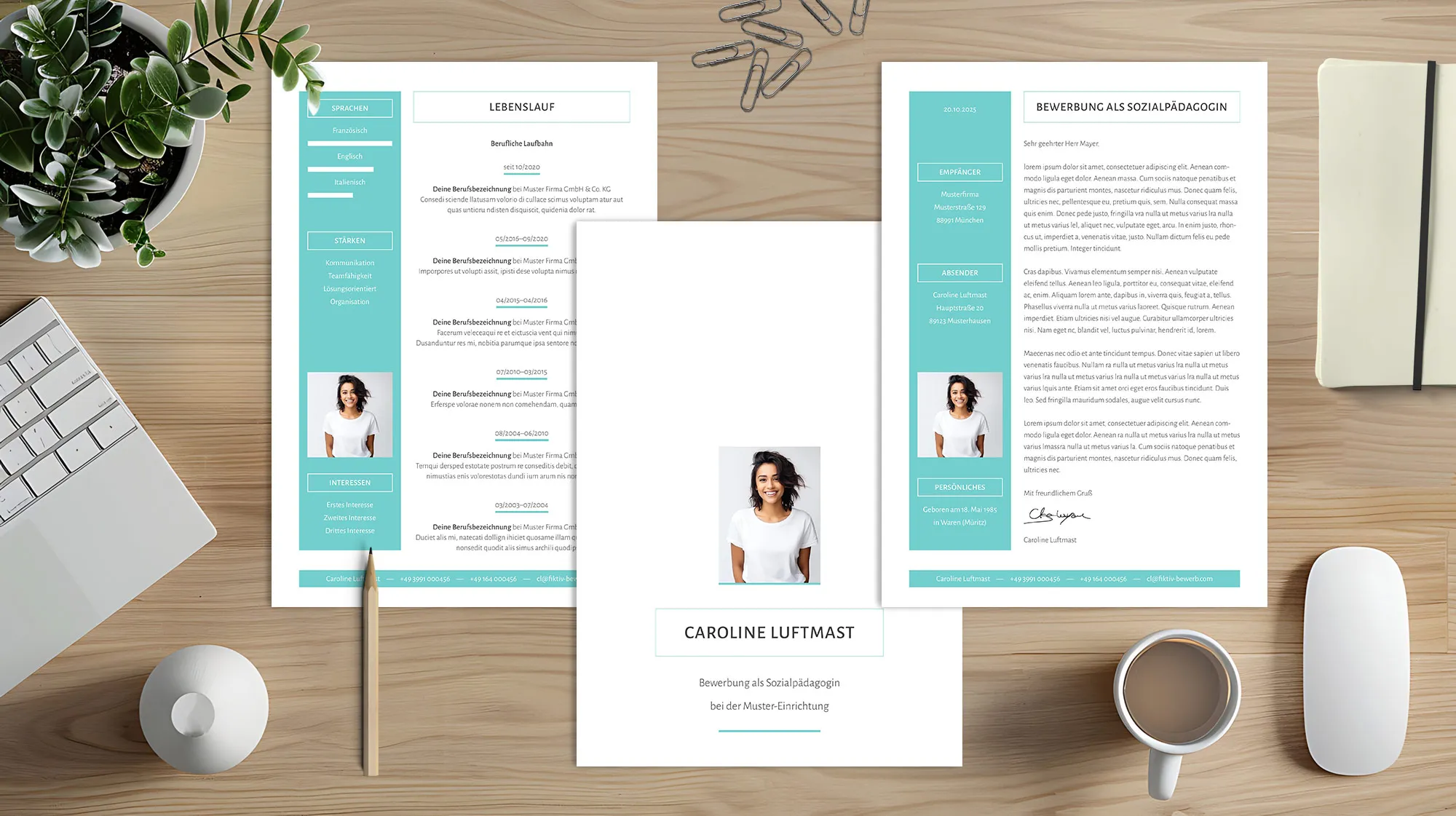

Perfect application: Designs as templates and tips for your resume

When applying for a position as a tax advisor, a well-structured and informative resume is essential. This helps you present your qualifications, experiences, and skills in a clear way, so that potential employers can quickly see why you are the ideal candidate for the position. Here you will learn what is particularly important.

- Education path: Clearly mention your degree in business administration, finance, or tax law. Include relevant further education and certificates, such as the tax advisor exam.

- Professional experience: List your previous activities in the fields of tax, accounting, and finance. Quantify your experiences by mentioning specific tasks and achievements.

- Technical competencies: Highlight your knowledge in tax law, bookkeeping, balance sheets, and financial planning. Emphasize in which areas you possess in-depth knowledge.

- Soft skills: In addition to technical knowledge, personal skills are also important. Mention, for example, your analytical skills, accuracy, sense of responsibility, and customer orientation.

- PC and software skills: Show that you are proficient in using tax and accounting software, such as DATEV or SAP. Knowledge of MS Office is also advantageous.

A well-structured resume is the key to a successful application as a tax advisor. With a clear presentation of your educational path, professional experience, and technical as well as personal competencies, you create the best conditions to convince potential employers and achieve your professional goals.

Get our individually designed application templates for Word and Co to optimize your application as a tax advisor and convince your desired company: