A transparent understanding of your personnel costs is crucial for financial success in the world of freelancing. Especially for web designers and graphic designers, it is essential to understand the structure of these costs in order to set fair hourly rates and acquire profitable projects. In this guide, you want to improve not only your calculation skills but also create a solid foundation for your entrepreneurial decisions.

Key Insights

Personnel costs consist of various components, including pension contributions, bonuses, and insurance. A comprehensive calculation model helps you secure a realistic income while covering all necessary expenses.

Step-by-Step Guide

1. Set Desired Salary

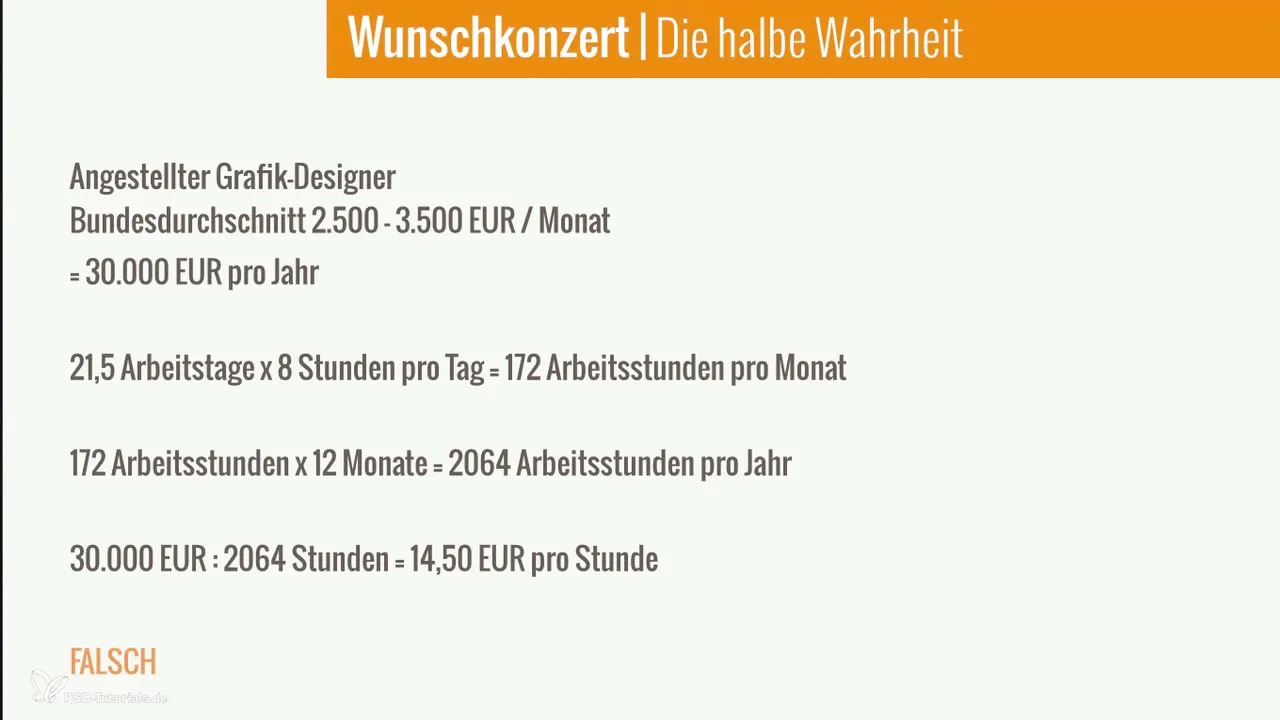

The first step in your calculation is to set your desired salary. If you have an annual salary of, for example, 30,000 €, you divide this by the number of hours you plan to work in a year. With 2,064 hours worked, this results in an hourly rate of about 14.50 €.

2. Analyze Personnel Costs

Personnel costs are not only relevant for employees in large companies; as a freelancer, you also have fixed costs that you need to consider. It is helpful to break down these costs as a percentage of your desired salary for a clearer overview.

3. Account for Pension and Additional Costs

Start with the costs for pensions. This includes health insurance. If you desire a salary of 30,000 €, you can expect about 4,500 € annually for your health insurance. It is better to use concrete numbers, so note how much you actually pay monthly for your insurance and multiply this by 12.

4. Consider Long-Term Care Insurance

Long-term care insurance also needs to be planned for. Here too, calculate with an annual amount that you pay concretely. It is important to consider each insurance in your cost planning to avoid financial surprises.

5. Plan for Retirement Savings

Retirement savings is another important point to include. On average, one should plan for 10 to 20% of your salary. Even if you think futuristically and say that you don't want to save much, plan for at least 10% to lay the groundwork for your retirement savings.

6. Disability Insurance

Also consider disability insurance, which typically accounts for between 5 and 10% of your salary. Even if this isn't directly part of your current planning, you shouldn't lose sight of it. Solid protection gives you security.

7. Liability and Legal Protection Insurance

Both liability and legal protection insurance are essential components of your cost calculation. Make sure you include the annual premiums in your budget. These are expenses that you must definitely consider.

8. Plan for Theft Insurance

If you have an office, you should consider taking out theft or electronics insurance. These insurances are important to protect your equipment against unexpected losses. Costs can vary depending on the value of your devices, but insurance costing between 200 and 300 € annually is a good investment.

9. Account for Bonuses

Freelancers should not hesitate to include bonuses such as bonuses, holiday pay, and Christmas bonuses in their calculations. These payments are important to create a balance between work and leisure. Remember that freelancing also means allowing yourself some time off.

10. Plan for Training Costs

Don't forget the costs for further training. Continuing education is crucial for your professional advancement. Calculate what you spend annually on workshops and courses and budget for this amount.

11. Consider Company Parties

Finally, expenses for company parties or team events are also an aspect of your personnel costs. Such events foster customer retention and team morale, so be sure to include these expenses in your planning.

Summary – Personnel Costs for Freelancers: How to Calculate Correctly

These steps show you how important it is to consider all aspects of your personnel costs to obtain a realistic picture of your financial situation. Based on the example of a 30,000 € annual salary, it follows that you need to generate about 46,500 € in revenue to cover all costs, including pensions, bonuses, and other incurred expenses.

Frequently Asked Questions

How do I calculate my desired salary?Divide your annual desired salary by the number of working hours you plan to work in the year.

What are the most important insurances for freelancers?Health insurance, long-term care insurance, and disability insurance are essential.

How much should my savings for retirement be?Calculate at least 10 to 20% of your income for retirement savings.

What is the average amount for bonuses?Plan for about 20% of your annual salary for bonuses.

Why are company parties important for my success?Company parties enhance team dynamics and strengthen customer relationships.