In this guide, you will learn everything important about registering a sole proprietorship in Germany. Often, this is the first step towards self-employment and can be done relatively quickly and easily. You will not only find out which documents are required, but also where to go and what legal aspects need to be considered. Let's go through the registration process together!

Main Findings:

- You need to have your ID card, a completed business registration form, and a fee of 26 euros ready.

- The registration is usually done at the responsible trade office in your place of residence and can sometimes also be done online.

- It is important to know that with a sole proprietorship, you are personally liable with your private assets.

Step-by-Step Guide

To successfully register a sole proprietorship, follow these steps:

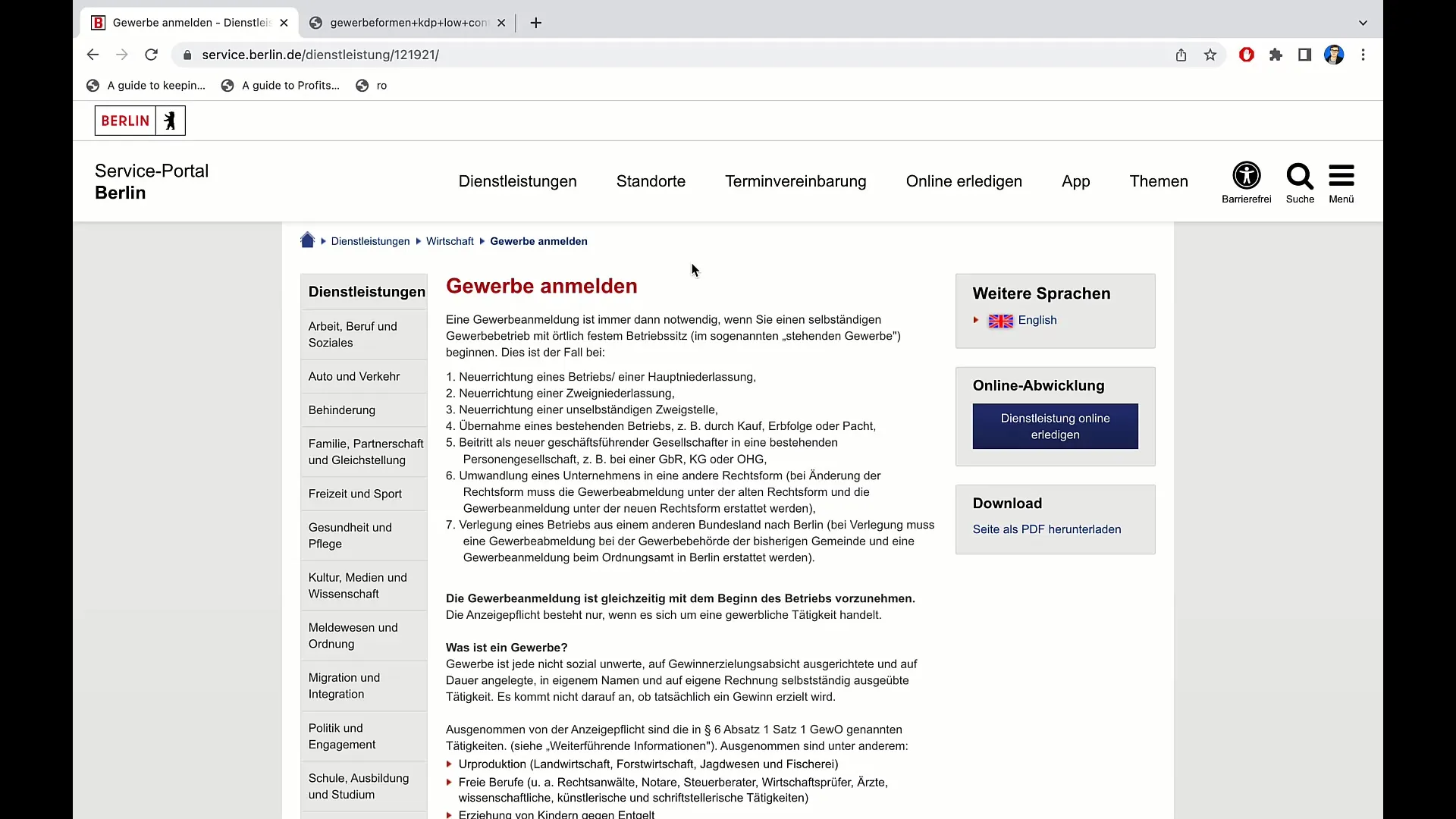

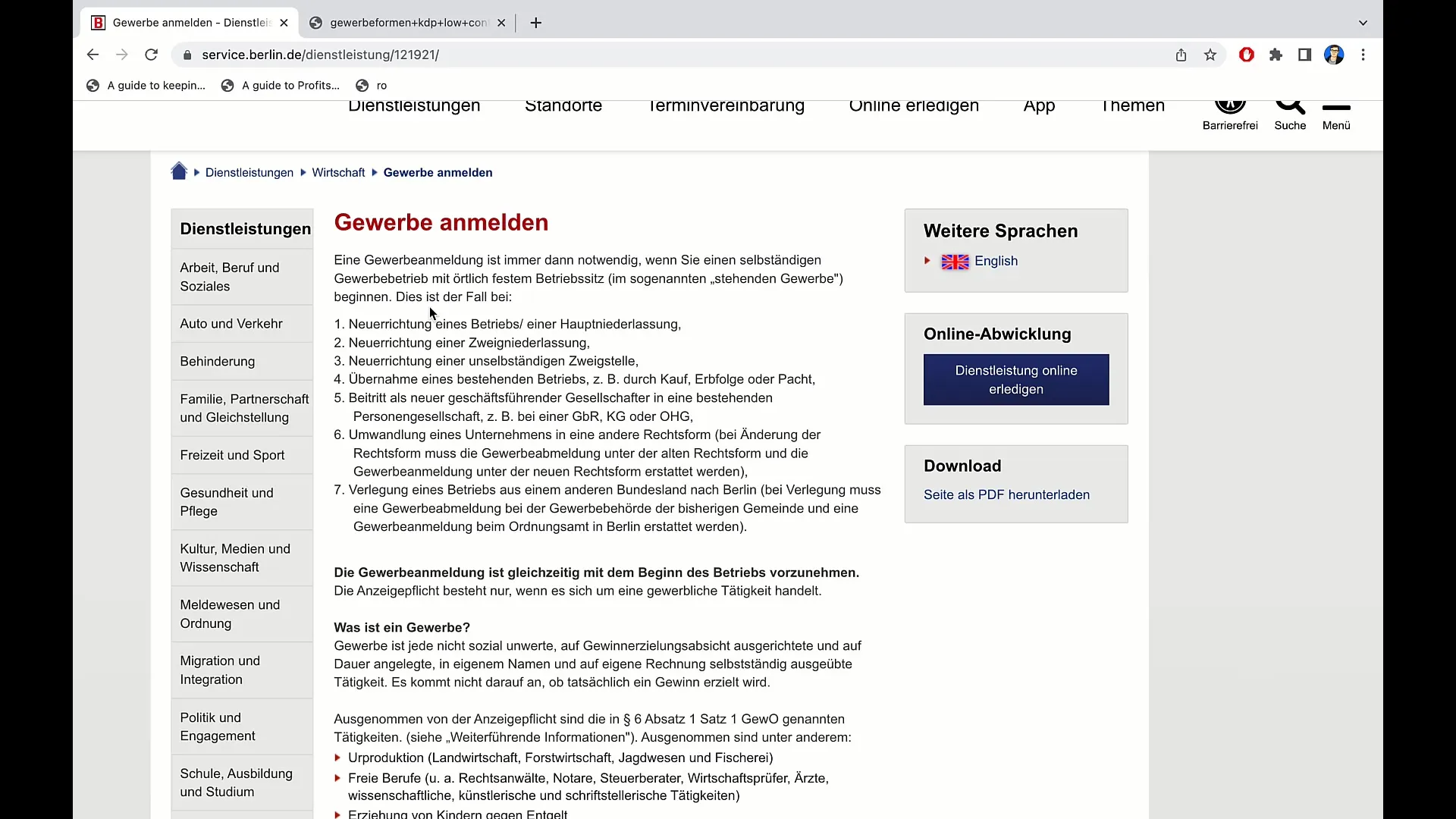

1. Gather Information

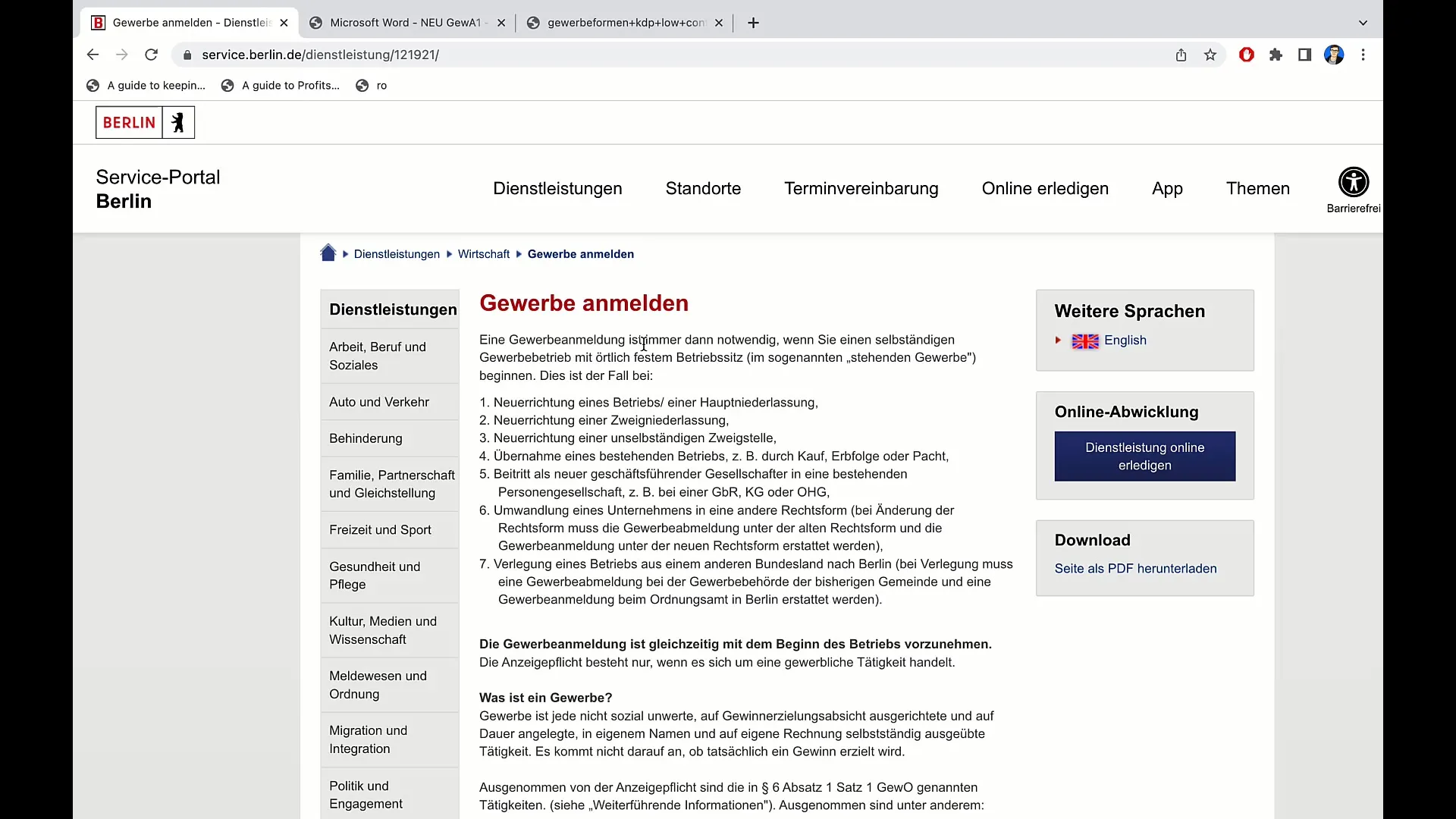

First, go to the service page of your federal state. The easiest way is to search on Google for "register a business [your federal state]." In Berlin, for example, the address would be service.berlin.de. There you will find relevant information and links for online or physical registration.

2. Check if Online Registration is Possible

In many federal states, you can register your business online. However, sometimes it may be necessary to appear in person at the trade office. In case of doubt, call the relevant office and inquire about the necessary steps and whether you need an appointment.

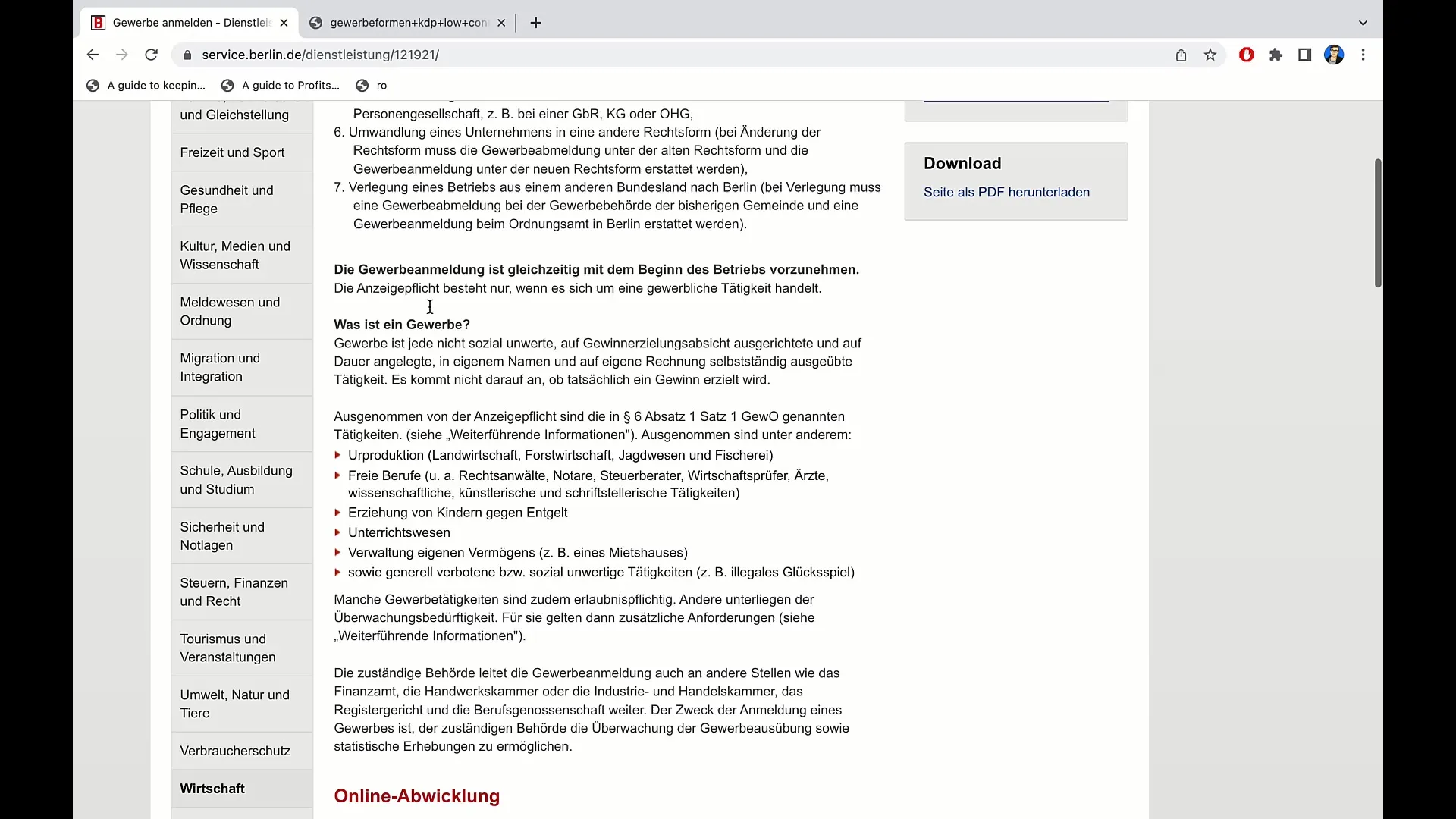

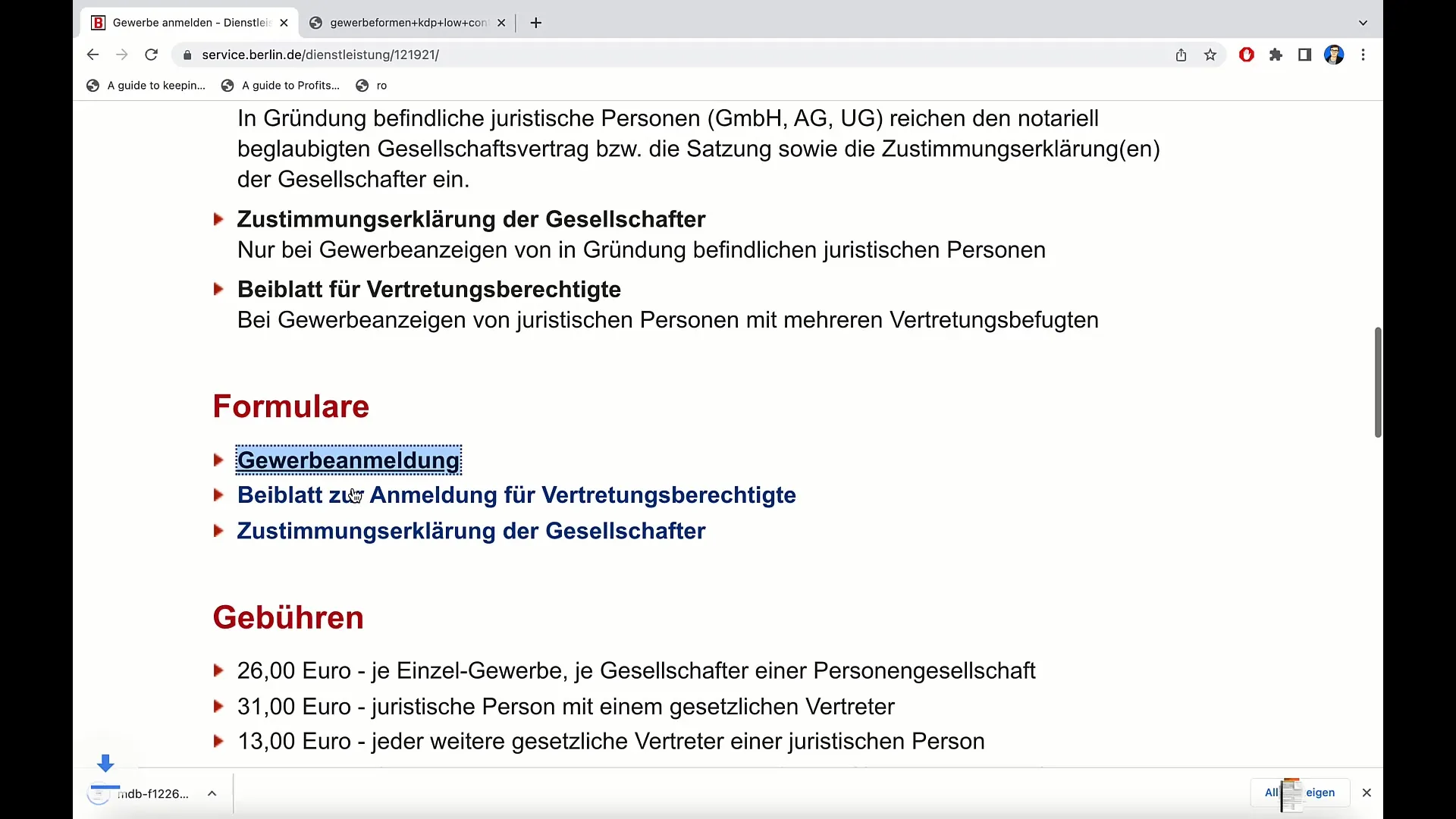

3. Required Documents and Fees

For registering a sole proprietorship, you need three main things: your ID card, a completed business registration form, and 26 euros. Make sure to bring the money in the exact amount, as many offices do not have change or insist on card payments. It may be worthwhile to clarify in advance how the respective office accepts the fee.

4. Fill Out the Business Registration Form

You can usually download the business registration form online. Fill it out diligently. Here you must provide your personal information, such as name, address, date of birth, and the type of business. This is important as it forms the basis for your registration.

5. Go Personally to the Trade Office

Go to the relevant trade office in your district with all the required documents. The office will review your documents and accept your application. Make sure to fill in all information correctly and completely to avoid delays.

6. Receive Stamp and Confirmation

After processing your documents successfully, you will receive a stamp on your business registration form confirming that your business has been registered. Keep this document safe as it is important for further steps.

7. Inform the Tax Office

After registering with the trade office, you must go to the tax office. There, you will receive a tax registration questionnaire. It is advisable to do this promptly to clarify your tax obligations in a timely manner and obtain all necessary licenses.

8. Fill Out the Tax Registration Form

The tax registration form must be filled out and returned. It may be advisable to involve a tax advisor to ensure that all information is correct and to take advantage of possible tax benefits.

Summary

Registering a sole proprietorship in Germany is a simple process that requires only a few steps. You need your ID card, the business registration form, and the fee of 26 euros. Personal contact with your trade office and submission to the tax office are essential points to consider. With the right preparations and information, nothing stands in the way of your self-employment!

Frequently Asked Questions

How long does the registration of a sole proprietorship take?Registration can usually be done within one day, depending on the waiting times at the trade office.

Do I need an appointment at the trade office?In many cases, no, but it is advisable to call ahead.

Can I also register my sole proprietorship online?Yes, in many federal states, online registration is possible.

How much does it cost to register a sole proprietorship?The fee is usually 26 euros.

Am I liable with my personal assets?Yes, in the case of a sole proprietorship, you are personally liable without limitation with your personal assets.