When it comes to e-commerce, it is crucial to have a competent tax advisor by your side. But how do you find the right tax advisor who not only understands your business, but can also cater to your specific needs? In this guide, you will learn how to find a good tax advisor and what you should pay attention to, so that you are well advised in the long term.

Main Takeaways

To find a suitable tax advisor, you should pay attention to the following points: the advisor's specialization, possible testimonials, the services offered, and the personal chemistry between you and the advisor. A good tax advisor should be able to handle different types of companies and offer comprehensive advice.

Step-by-Step Guide

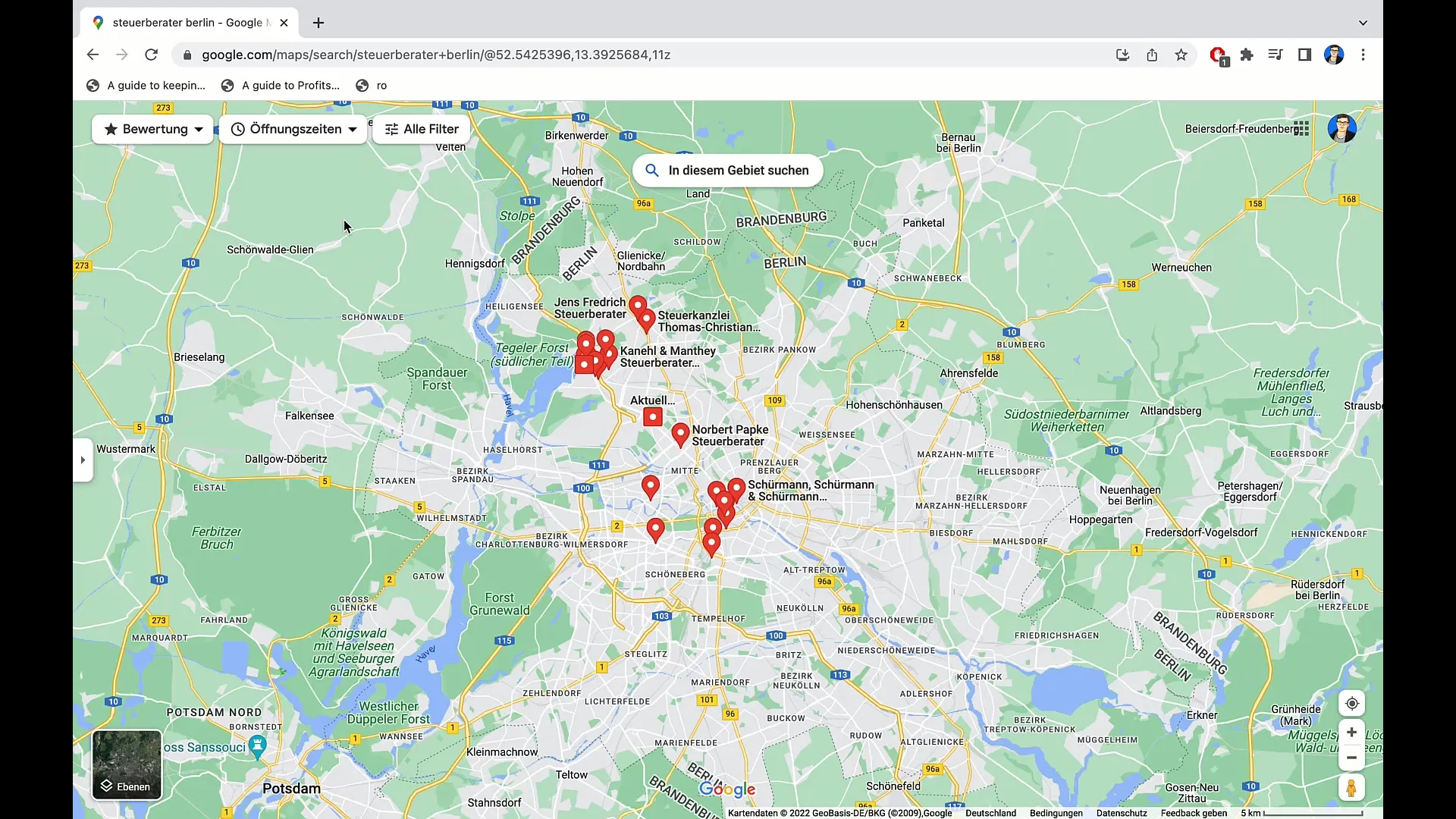

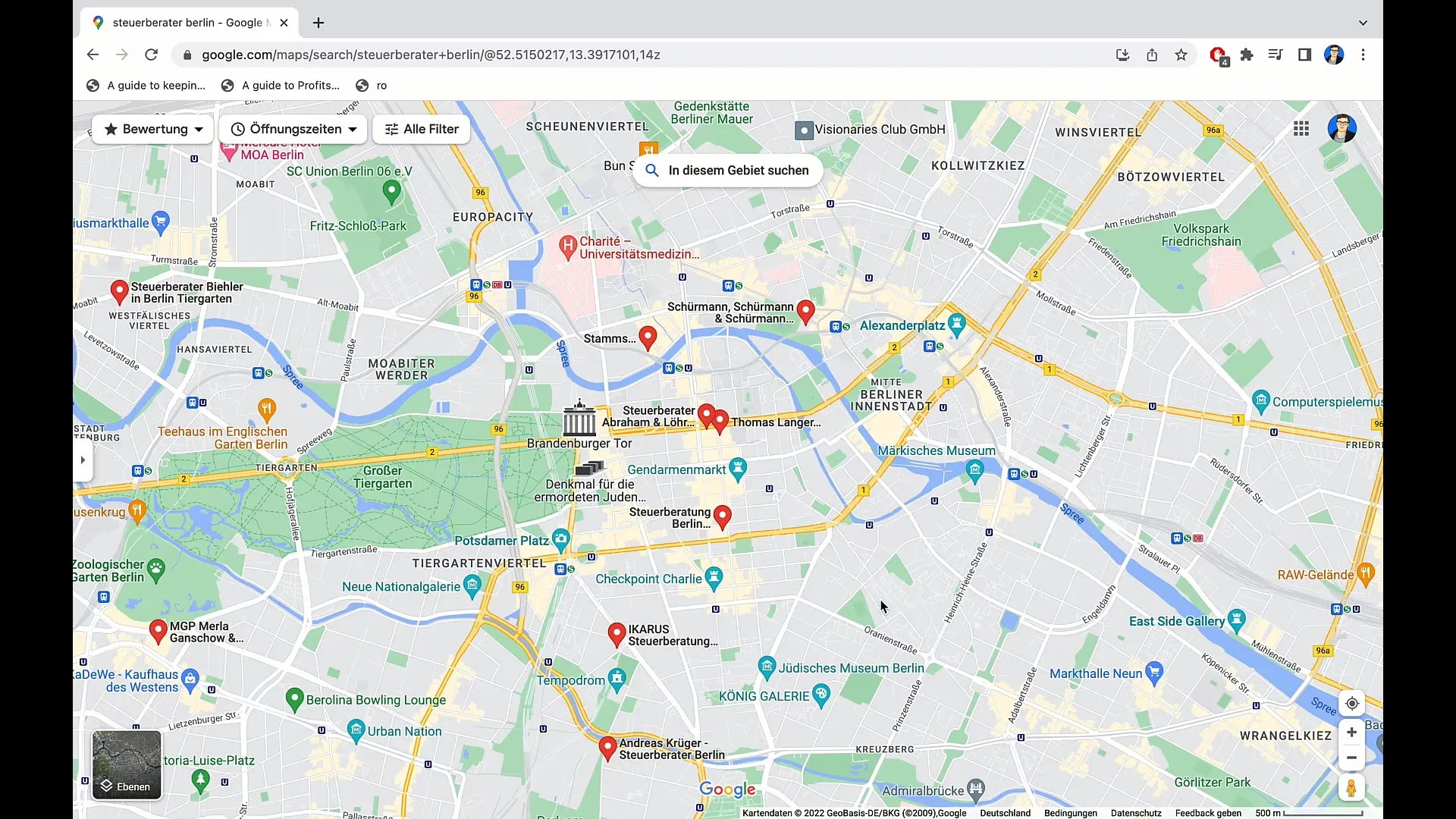

1. Use Google Maps for Research

The first step in finding a tax advisor is to use Google Maps. Simply enter the term "tax advisor" followed by your place of residence in the search bar. For example, if you live in Berlin, type "tax advisor Berlin". You will receive a list of tax advisors in your area that you can then investigate further.

2. Visit the Tax Advisors' Websites

Once you have found a list of potential tax advisors, visit their websites. Pay attention to the types of clients the tax advisor accepts. Some tax advisors specialize in certain target groups, such as employees or small business owners, and do not work with corporations. It is important to choose an advisor who can cover the variety of your business activities.

3. Check the Services Offered

Make sure that the tax advisor offers various services that you may need, such as annual financial statements, payroll accounting, or advance VAT returns. If the tax advisor is well positioned in these areas, it speaks to their qualifications.

4. Research Testimonials

Another crucial step is to research testimonials. Read online reviews and feedback from former or current clients. Positive experiences indicate good service, while many negative reviews can be a warning sign. If you come across many negative reviews for a tax advisor, this should be a reason for caution.

5. Schedule a First Meeting

Make a preselection of two to three tax advisors and schedule a meeting. In this initial conversation, you can find out if the advisor is the right fit for you. Pay attention during the conversation to how well you get along with the tax advisor and whether they are interested in your concerns.

6. Recognize the Specialization

It can also be helpful to look for tax advisors specializing in E-Commerce. If a tax advisor is knowledgeable in this field, they can offer you specific advice tailored to the unique requirements of your E-Commerce business. Be prepared to clearly explain your requirements to the advisor.

7. Evaluate Price-Performance Ratio

Make sure to weigh the costs of a tax advisor's services against a clear price-performance ratio. Highly specialized tax advisors may be more expensive, but may provide added value through their expertise. Consider whether you truly need a specialized tax advisor or if a generalist advisor can sufficiently meet your initial requirements.

8. Long-Term Collaboration and Availability

When selecting a tax advisor for the first time, also consider the possibility of a long-term collaboration. A younger tax advisor or an established firm could be more attractive as they are likely to remain available in the future, while older tax advisors may retire and close their practice soon.

9. Chemistry and Personal Connection

The final point to consider is the personal chemistry between you and the tax advisor. It is important that you get along well with your advisor and trust them. The ability to openly discuss your concerns is of great value. Trust your instincts: If you have a good feeling, it is often an indicator of a successful collaboration.

Summary

In this guide, you have learned how to find a suitable tax advisor. Pay attention to considering specialization, experience, services, and personal chemistry to make the best choice for your e-commerce business.

Frequently Asked Questions

How do I find a good tax advisor?Use Google Maps to find tax advisors near you. Visit their websites and learn about their specializations and services.

What are important points to consider when choosing?Pay attention to specialization, testimonials, and whether the tax advisor offers all necessary services.

How important are online reviews?Online reviews give you insights into the experiences of other clients and can be warning signs if there are many negative feedbacks.

Why is personal chemistry important?A good relationship helps you have open conversations and solve problems more effectively. Trust is crucial for a successful collaboration.

What should I do if I am not sure?Make a preselection and schedule meetings with several tax advisors to gather different impressions.