In the dynamic world of E-Commerce, it is crucial to choose the appropriate legal form for your company. In today's tutorial, you will not only learn about the different legal forms, but also the advantages and disadvantages associated with each form. Whether you are a solo entrepreneur or want to start a business with others, making the right decision can greatly benefit your business model.

Key Insights

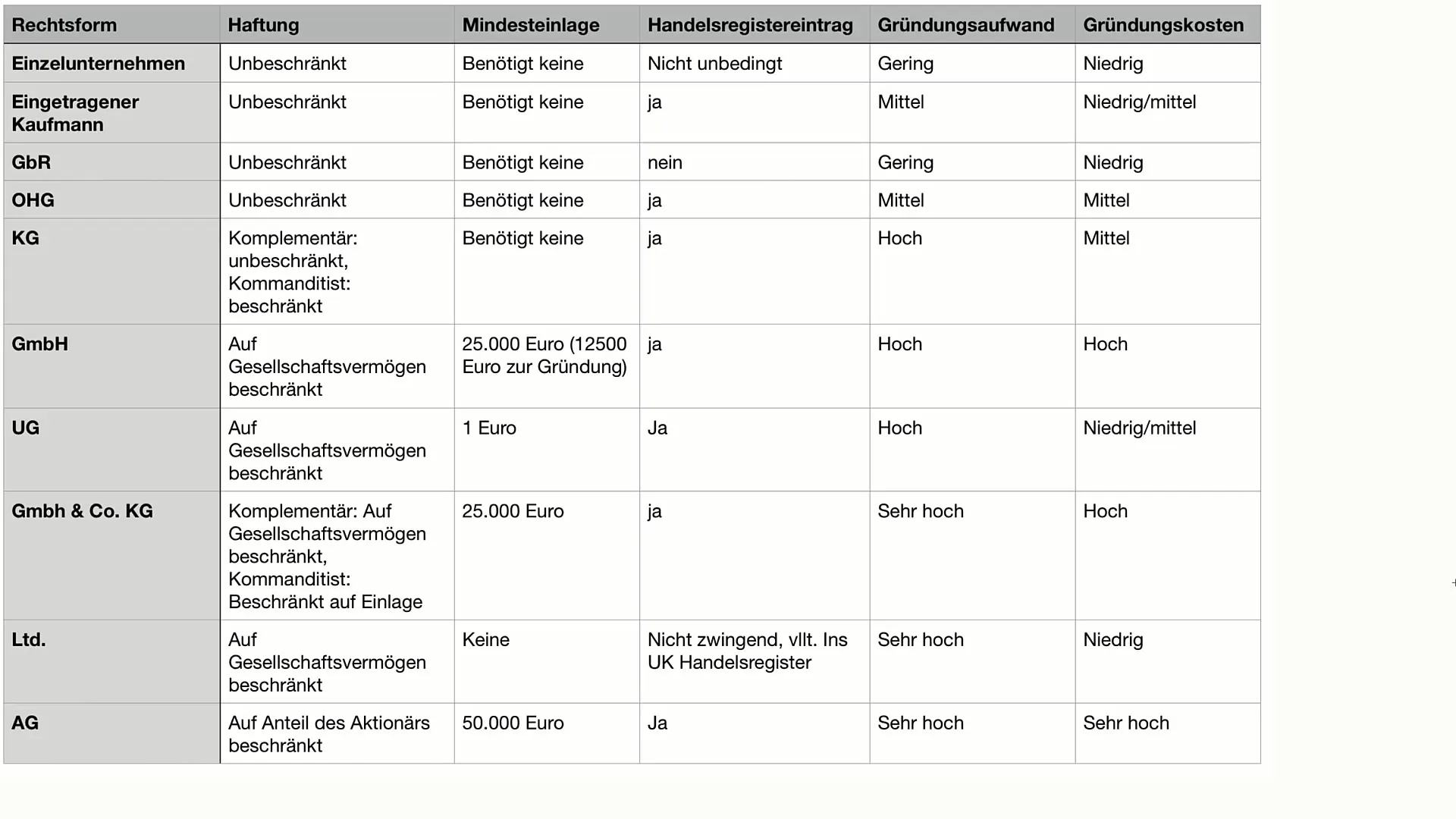

The choice of legal form depends heavily on your individual needs and goals. The most common forms for E-Commerce are:

- Sole Proprietorship

- Limited Liability Company (GmbH)

- Entrepreneurial Company (UG)

- Civil Law Partnership (GbR)

Each of these forms has unique features regarding liability, costs, and effort in the establishment process.

Step-by-Step Guide

1. Sole Proprietorship

The sole proprietorship is the simplest form of self-employment. Here, you are liable with your entire personal assets.

Initially, you do not need any initial capital for registering your sole proprietorship. This means you can start with a budget of €0, apart from the registration costs.

The founding costs amount to about €26 in many German cities. The effort for establishment is manageable and usually takes between 24 hours and a week.

2. Registered Merchant (e.K.)

The registered merchant has unlimited liability, but a commercial register entry is required. The minimum capital is also €0 here.

The effort in the establishment process is slightly higher compared to the sole proprietorship, as you need to be registered in the commercial register.

3. Civil Law Partnership (GbR)

The GbR is particularly suitable for founders who want to run a company together. In this legal form as well, you are liable with your personal assets.

No minimum deposit is required, and founding costs are low.

4. General Partnership (OHG)

The OHG is an advanced form of the GbR, but it must also be registered in the commercial register.

The founding costs are higher as the OHG must meet formal requirements, such as creating a partnership agreement.

5. Limited Partnership (KG)

In the KG, there is both a general partner and a limited partner. The general partner has unlimited liability, while the limited partner has limited liability.

The founding costs are medium to high, as a commercial register entry is required here as well.

6. Limited Liability Company (GmbH)

The GmbH is a very popular form as it offers liability limited to the company's assets. A minimum deposit of €25,000 is required.

The founding costs are higher, as you legally represent the company and must fulfill certain requirements.

7. Entrepreneurial Company (UG)

The UG, also known as Mini-GmbH, allows founding with only a minimum deposit of €1. Although you also have liability limited to the company's assets here, the founding effort and costs are lower than with the GmbH.

The UG is an attractive option for founders with low starting capital.

8. Ltd. (Limited Company)

The Ltd. is primarily used in the United Kingdom but is also possible in Germany. You are only liable with the company's assets.

No minimum capital is required here, making this form very interesting. Moreover, the founding costs are generally low.

9. Stock Corporation (AG)

The AG is a highly regulated legal form that requires a minimum deposit of €50,000. However, this form is not relevant for most E-Commerce founders.

The effort and costs of establishment are very high here, which is often impractical for smaller E-Commerce projects.

Conclusion: Which form is best for you?

If you want to start a business alone, sole proprietorship or UG are good options. If you are starting a business with partners, GbR or UG is advisable.

However, if you desire limited liability, then GmbH or UG is recommended as the legal form.

Summary

Choosing the right form of business not only affects your liability, but also future business opportunities. Carefully examine the advantages and disadvantages of each form to make an informed decision.

Frequently Asked Questions

What is a sole proprietorship?A sole proprietorship is the most common form of self-employment, where you are personally liable with all your assets.

How much capital do I need for a GmbH?To establish a GmbH, you need a minimum share capital of €25,000.

What is the difference between UG and GmbH?The UG is a limited liability form of business with a minimum contribution of €1, while the GmbH requires a minimum capital of €25,000.

What is a GbR?A GbR is a civil law partnership formed by multiple individuals who have unlimited liability.

Do I need a commercial register entry for an OHG?Yes, an entry in the commercial register is required for the general partnership.