Here is an overview of the individual chapters:

01: Career aspirations in photography

The desire for recognition as a driving force

The profession of photographer between cliché and reality

02: Questions about suitability

Personal aptitude: "doer" vs. doubter

Factual requirements

Monetary requirements

Supportive environment

03: Getting started in professional photography

Internships and assistantships

The classic, craft-based training

The academic path (photography studies)

Private photography schools

The self-taught path (lateral entry)

04: The photo studio

Own studio vs. rental studio

Advantages and disadvantages of a shared studio

Tips on the rental contract

Tips on location

Tips on the suitability and sensible furnishing of your own photo studio

05: Positioning and objectives

All-rounder or specialist?

Fields of activity

The curse and blessing of the photo agency business

06: Dealing with authorities & Co.

The status of an artist

Registration with the tax office

Registration with the trade registration office

Chamber of Industry and Commerce (IHK) and Chamber of Crafts

Social insurance: Registration with the artists' social insurance fund

Registration with the employers' liability insurance association

VG Bild-Kunst

07: Sensible advertising measures

Targeted advertising

Flyer advertising

Business cards

Internet presence

Shop window design

Acquiring advertising agencies and publishers

08: How do I do my first photo job professionally, efficiently, financially successfully and legally securely?

Preparing an offer

Confirmation letter

Processing

Invoicing

Dunning

09: Legal matters

10: Taxes

Sales tax small business

The question of the correct tax rate

Turnover tax

Income tax

Outlook

Useful links and recommended reading

Everything must be in order... Register your activity as a photographer to avoid trouble with the authorities or chambers.

The status of artist

Artist or tradesman? This is the question that everyone who wants to start generating income with their photos has to ask themselves.

Even before you contact the tax office to register your professional activity as a photographer, you should think carefully about your status as a photographer and the area(s) in which you will be working in the future.

There is a difference between registering as a photo designer who mainly creates artistic photographs and registering as a commercial photographer who works as a craftsman. The latter means that, in addition to income tax, you would have to pay trade tax and Chamber of Industry and Commerce or Chamber of Crafts contributions (compulsory membership! See below!) from a certain level of earnings. If you become self-employed as a photo designer, i.e. as an artist, you do not have to pay trade tax and Chamber of Industry and Commerce contributions.

However, not everyone is free to decide whether they want to become a freelance photo designer or a freelance photographer. The decisive factor is the activity actually carried out. For example, a portrait photographer who mainly takes biometric passport photos cannot claim to be working as an artist.

When differentiating which photographs are to be regarded as artistic and which are not, tax law requires that, in addition to mastery of the technique, the photos must above all contain something "original" and also achieve a "certain artistic level of design" in order to recognize the status of an artist. In other words, a personal signature and a creative touch are required in the photographs.

Other criteria that suggest an artistically active photographer are membership of artists' associations, regular exhibitions and public recognition (for example through art awards), artistic training or a corresponding degree, etc.

It would be counterproductive for recognition as an artist to be entered in the commercial register or in the register of craftsmen, as this requires the predominance of a commercial or craft activity, which then contradicts the status of artist.

The form in which your photos are used, for example in the context of advertising for a company, is no longer decisive for the classification since a few years and a corresponding court ruling. If there is a difference of opinion with the tax authorities, a neutral, knowledgeable expert should be involved in the decision-making process, whose opinion will be decisive.

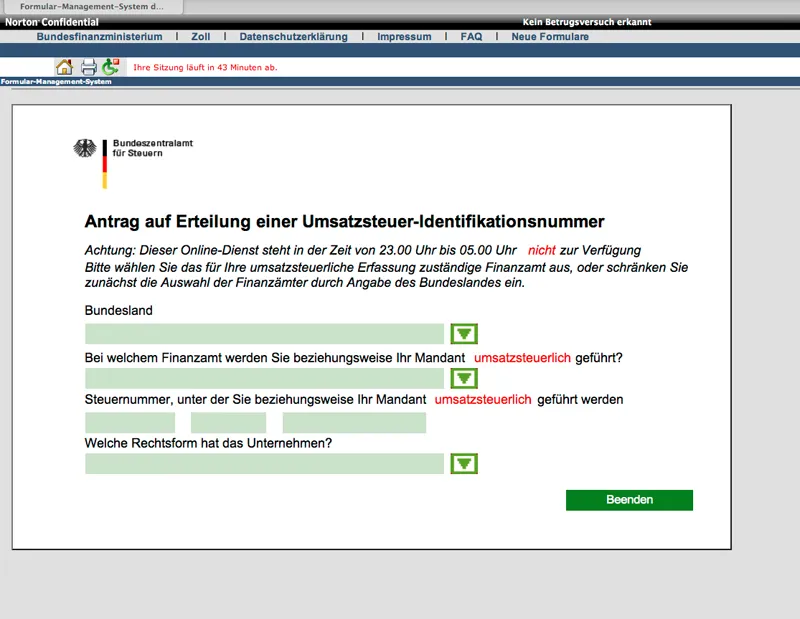

Registering with the tax office

Anyone who takes up freelance work as a photographer must register with the tax office. It does not matter whether the income is only generated occasionally or regularly, i.e. whether you work full-time or as a sideline. The notification can be made in the form of a simple letter, a personal presentation is not necessary. After registering, you will be assigned a tax number, which must appear on every invoice issued. As an alternative to the tax number, a VAT identification number can also be used.

You can find the application for a VAT identification number at https://www.formulare-bfinv.de (menu item: Assignment of a VAT ID).

Registration with the trade registration office

If you have determined that you are more likely to be classified as a professional photographer, i.e. you mainly take passport, portrait and wedding photos for which you have little or no scope for artistic design, you must register with the trade register of the municipality. According to Section 14 of the Trade, Commerce and Industry Regulation Act (GewO), notification is mandatory. The respective public order office is responsible for the municipal trade register.

You will need an identity card or passport to register (in person) a business that does not require a permit. However, some offices also offer online registration. The business registration is subject to a fee and costs between 20 and 40 euros.

For a few years now, anyone can become self-employed as a professional photographer; photographers are no longer required to be master craftsmen. The master craftsman's certificate is no longer a prerequisite for running a photography business.

Other authorities, such as the tax office, trade supervisory office or the chambers of industry and commerce, are automatically informed of this once you have registered your business, so you can save yourself these additional steps.

Chamber of Industry and Commerce (IHK) and Chamber of Crafts

Tradespeople are automatically members of the Chamber of Industry and Commerce. They are subject to compulsory membership and are therefore required to register, but this is fulfilled when the business is registered with the public order office.

There is an exception if you run a (photographic) craft business. In this case, it is no longer the IHK but the Chamber of Crafts that is responsible. According to the Third Act Amending the Crafts Code and Other Crafts Regulations of 2003, the profession of photographer is one of the professions that does not require a license, meaning that it can be practiced from 01.01.2004 even without passing a master craftsman's examination. However, you must still be entered in the Register of Craftsmen and therefore also pay contributions to the Chamber of Crafts.

However, if you work as an artist (as a freelancer) or publicist, you do not need to register your professional activity with the Chamber of Industry and Commerce or the Chamber of Crafts, as artists and publicists are exempt from compulsory membership.

Social insurance: Registration with the artists' social insurance fund

The contributions to the Künstlersozialkasse (KSK) are extremely favorable, as the insured persons only have to pay about half of the contributions. The other half is paid by the federal government and the users of the artists' and publicists' work, for example publishers, galleries, advertising agencies, concert organizers, etc., i.e. anyone who - in the case of photographers - uses the images by publishing them. The KSK states: "The special feature here is that artists and publicists only have to pay about half of their contributions themselves and are therefore in a similarly favorable position to employees. The other half of the contributions is financed by a federal subsidy and a levy on companies that exploit artistic and journalistic services."

This regulation therefore puts self-employed artists and publicists in a similar position to permanent employees. The legislator has therefore attempted to take account of the fact that artists and publicists generally work on a freelance basis and do not permanently serve a single employee.

According to the law, the Künstlersozialkasse is therefore open to photographers working as artists, but also to photojournalists and press photographers, as they work in the field of journalism.

Press photographers can also apply to join the Künstlersozialkasse.

For some years now, it has no longer been decisive whether the person who took the artistic photos is insured with the KSK when it comes to the fact that users such as advertising agencies have to pay a levy to the KSK. What counts now is the service that was provided.

It is not enough to "just" take artistic and appealing photos. When applying for admission to the KSK, you must also prove that you are taking photographs with the intention of generating income. The KSK examination board decides on admission.

Together with the application for admission, the applicant must submit, if available

- Proof of artistic or journalistic training, e.g. diploma certificate, degree certificate, certificate of study

- Contracts with clients (not older than 1 year)

- Invoices from clients for fees paid or invoices issued by the applicant together with a bank statement confirming receipt of the invoiced amounts

- Own current advertising material (e.g. brochures, posters, leaflets, flyers, printout of the website)

- Evaluations from third parties (e.g. prizes, scholarships)

- Some exemplary evidence of publications / exhibitions / concerts / performances (e.g. newspaper articles, advance notices, exhibition invitations, excerpts from catalogs); this evidence should not be older than 1 year

- Certificate of membership of professional interest groups or pension schemes

- Proof of recognition in the professional circles of visual artists

- Other proof of activity

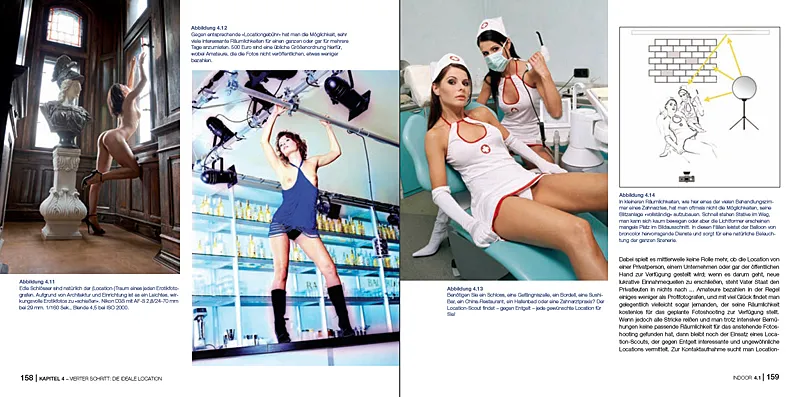

Anyone who only takes biometric passport photos all day will not find favor with the Artists' Social Security Fund when they send in their application for membership. However, if the applicant takes photos like the one shown here, it is more likely that they will be accepted into the KSK.

The amount of contributions for pension, health and long-term care insurance that the insured person has to pay each month is based on the photographer's "expected annual earned income". The "annual earned income" is the difference between operating income and operating expenses, i.e. the profit. Due to the typical fluctuations in artists' income, the legislator has decided to use the annual rather than the monthly income as the basis for calculation. The prospective annual income for the coming year is estimated by the insured person in the fall of the previous year (by December 1 at the latest) and reported to the KSK using the "Form for declaring the prospective annual income".

Registration with the employers' liability insurance association

By law, every entrepreneur is a member of a trade association. The purpose of this compulsory membership is to provide all entrepreneurs with a basis for (statutory) accident insurance, which is provided by the employers' liability insurance association.

The employers' liability insurance association compensates for

- Accidents at work

- commuting accidents (including, for example, accidents on the way to customers)

- Occupational illnesses

The employers' liability insurance association covers the costs of medical treatment for accidents at work. Provided you have registered in good time. An accident at work can happen faster than you think: I've fallen off a ladder several times while taking photos. Fortunately, I've only suffered a few scrapes and bruises so far.

Photographers (including freelance artists) are compulsorily insured with the Employer's Liability Insurance Association for Energy, Textiles, Electrical and Media Products (BG ETEM); within BG ETEM, the sector administration for printing and paper processing is responsible. Voluntary accident insurance taken out privately does not exempt you from compulsory membership.

The amount of the contribution to be paid is not calculated on the basis of income. Every self-employed person chooses their own sum insured, which then determines the financial benefits paid by the employers' liability insurance association in the event of an insured event.

VG Bild-Kunst

VG Bild-Kunst (VG = Verwertungsgesellschaft) is "an association founded by authors (...) to protect their rights". Artists, photographers and film authors are named as rightholders. Consequently, they can conclude a rights administration agreement with VG Bild-Kunst, which transfers the administration of rights to VG Bild-Kunst and enables them to earn additional income.

The tasks of VG Bild-Kunst are thus comparable to the activities of VG Wort and GEMA (GemA = Gesellschaft für musikalische Aufführungs- und mechanische Vervielfältigungsrechte).

The tasks of VG Bild-Kunst are as follows

- Collection and distribution of flat-rate copyright fees

- Licensing and enforcement of individual rights

- Political and legal strengthening of copyright protection

The individual photographer would never have been able to assert the perfectly justified claims against third parties (occasionally also referred to as secondary usage rights) on the basis of legal regulations or practical considerations. For example, the individual claim resulting from the library royalty is excluded by law; only collective claims are accepted here, which is understandable if one imagines the administrative burden if each image author were to assert individual claims against the libraries due to the fact that books in the collection contain his photos (and are viewed by many people). The same applies to the press review fee (especially the magazines that are in the reading circle and can be found in doctors' waiting rooms, for example, are read by many people) and the photocopying fee (books are often photocopied, which deprives the author and the publishers of royalties).

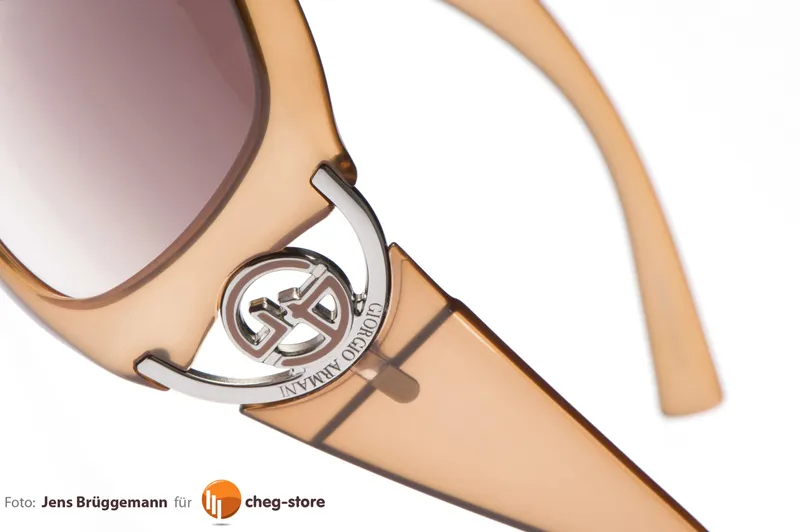

I have also registered the number of photos used in my photography textbooks (here is an excerpt from the new edition of the book Moderne Erotische Digital-Fotografie) with VG Bild-Kunst.

After becoming a member, photographers can register their individual publications with VG Bild-Kunst, which can be done very conveniently online. The most common publications here will be image sales to magazines. However, commissioned works placed on the Internet by customers (which is likely to be the case with advertising photos on a regular basis) or published on book titles or music CDs can also be reported.

However, in order for them to be taken into account in the distribution, claims must be registered by filling out the registration forms in good time. The deadline for paper forms is June 30; online entries will be considered until October 31.

However, calendar publications will not be considered by VG Bild-Kunst. Although there is an entry option in the online entry menu for the book entry card, the entry cannot be sent; an error message appears stating that calendars cannot be considered.