The Customer Lifetime Value (CLV) is a crucial factor in marketing, especially in affiliate marketing. It provides insight into how much a customer is worth over the course of their relationship with a company. This not only helps in calculating marketing expenses but also in strategic planning and aligning the content marketing strategy. In this guide, you will learn how to calculate the CLV, what metrics are necessary for it, and how to effectively integrate these calculations into your business strategy.

Key Insights

- The Customer Lifetime Value (CLV) is an important metric in marketing.

- The CLV represents the total value of a customer during their relationship with a company.

- It can be calculated using various metrics such as customer lifetime, customer revenue, contribution margin, and customer acquisition costs.

- Calculating the CLV can help make informed decisions regarding marketing strategies.

Step-by-Step Guide to Calculate the Customer Lifetime Value

Step 1: Determining Customer Lifetime

First, you need to determine the customer lifetime, which can be expressed in days or years. The timeframe depends on the type of product or service you offer. For example, an online store may have a shorter customer lifetime compared to a company selling high-priced services.

Step 2: Calculating Customer Revenue

Customer revenue is the amount a customer spends throughout their entire relationship with your company. You should calculate this revenue for the defined timeframe of the customer lifetime.

Step 3: Considering Contribution Margin

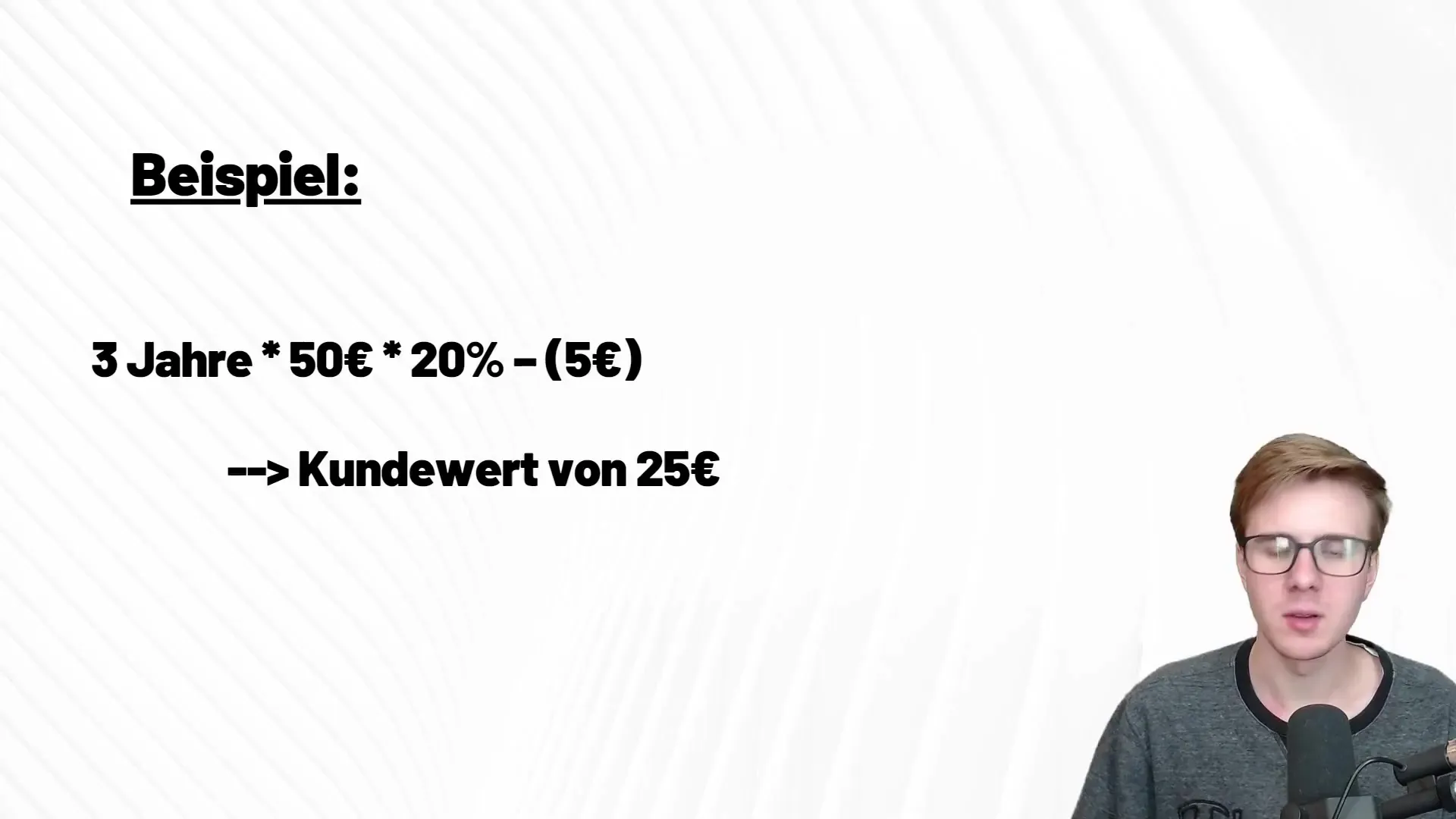

The contribution margin is the amount you have left after deducting the variable costs for a product or service. In the video's example, this was 20%. Calculate your contribution margin to understand how much profit you can generate from a customer's revenue.

Step 4: Subtracting Customer Acquisition and Retention Costs

When calculating the CLV, you also need to consider the costs of customer acquisition and retention. These are the expenses required to acquire a customer and to support them throughout their lifetime. These costs should be subtracted from your expected revenue.

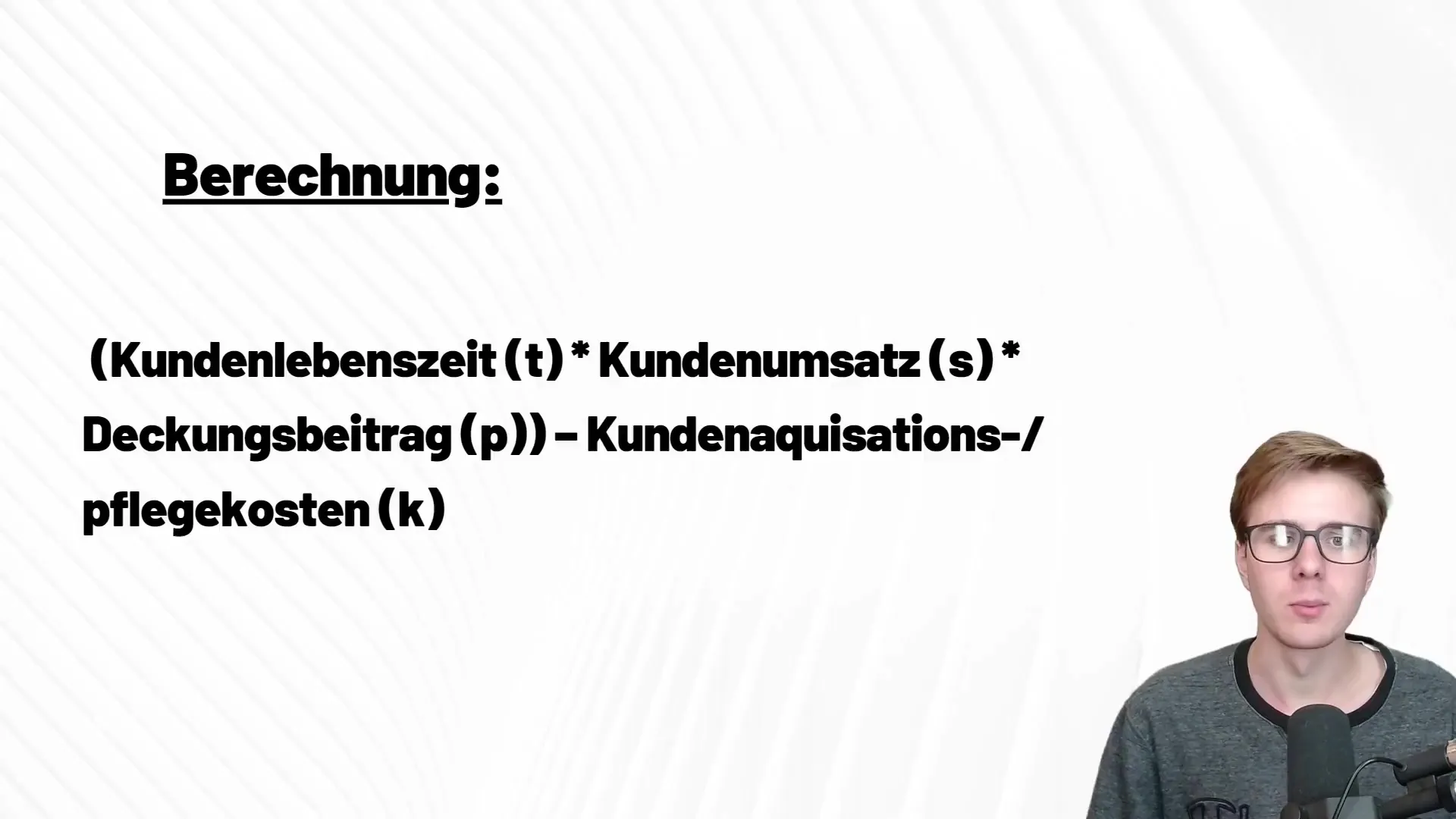

Step 5: Performing the Final CLV Calculation

Now that you have all the necessary values (customer lifetime, customer revenue, contribution margin, and acquisition and retention costs), you can calculate the CLV. Use the following formula:

[ CLV = (Customer Lifetime x Customer Revenue x Contribution Margin) - Acquisition and Retention Costs ]

Step 6: Analyzing Your Results

Analyze the results to understand how valuable your customers are. It is important to not only look at the numbers but also consider what type of customers you want to attract. For example, it can be a challenge to attract very high-spending customers who are not loyal. Sometimes, loyal customers who spend less can be more valuable for your company.

Summary

The Customer Lifetime Value is a crucial metric that helps you understand the value of a customer over their entire relationship with your company. By carefully calculating the key parameters, you can make informed decisions and optimize your marketing strategies.

Frequently Asked Questions

What is the Customer Lifetime Value?The Customer Lifetime Value (CLV) represents the total value a customer has during their relationship with a company.

How do I calculate the CLV?The CLV is determined by the formula: (Customer Lifetime x Customer Revenue x Contribution Margin) - Acquisition and Retention Costs.

What impact does the CLV have on my marketing strategy?A higher CLV allows you to invest more in customer acquisition, knowing that the customer is profitable throughout their lifetime.

Why is it important to have loyal customers?Loyal customers tend to make recurring purchases and can bring in new customers through referrals, reducing the costs of acquiring new customers.

How can I increase the CLV?You can increase the CLV by strengthening customer loyalty, improving customer service, and increasing sales through targeted marketing efforts.