In order to be successful in competition, it is essential to thoroughly analyze your own customers and their value for the company. The ABC customer analysis plays a crucial role in this. It helps you divide your customers into categories and calculate the Customer Lifetime Value (CLV) – one of the most relevant business metrics. In this guide, you will learn how to conduct an effective ABC analysis and determine the CLV for your customers.

Key Insights

- The ABC customer analysis helps classify customers based on their revenue contribution.

- The Customer Lifetime Value is an important metric for evaluating the profitability of customers.

- An effective customer acquisition should focus on A-customers who provide the highest value.

Step-by-Step Guide

Step 1: Understanding the ABC Analysis

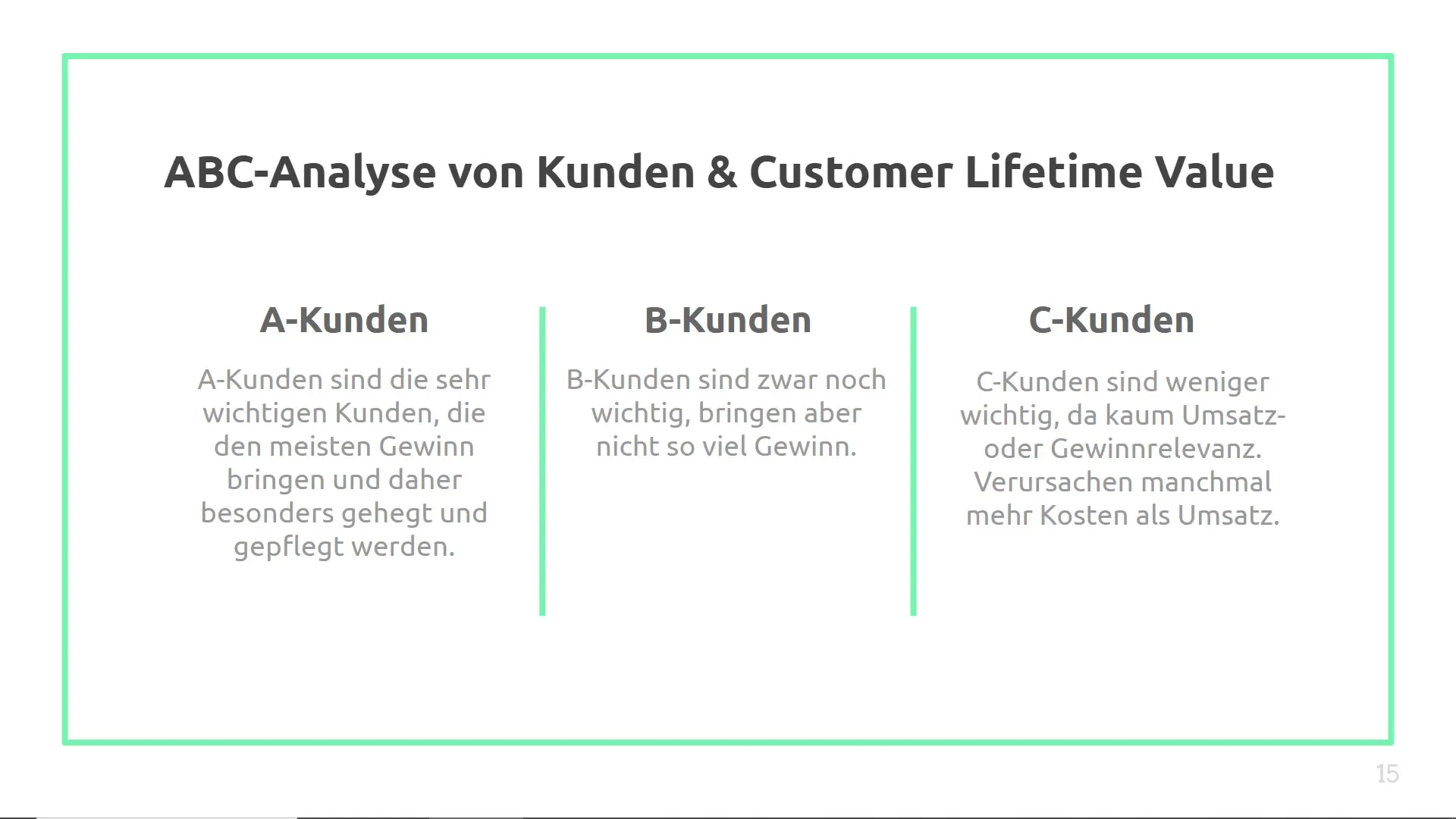

The ABC customer analysis divides customers into three categories:

- A-customers are the most important customers who contribute the most to company profits.

- B-customers are also important but not as profitable as A-customers.

- C-customers bring in minimal profits and often incur higher costs than revenue.

This classification ensures that you can focus your resources on the customers who bring you the most value.

Step 2: Determining the Customer Lifetime Value

The Customer Lifetime Value indicates how much profit you can expect over the entire duration of the customer relationship. To calculate this value, you need the following information:

- the average customer lifespan (in years),

- the average annual revenue per customer,

- the profit margin,

- and the customer acquisition costs.

The basic formula for CLV is:

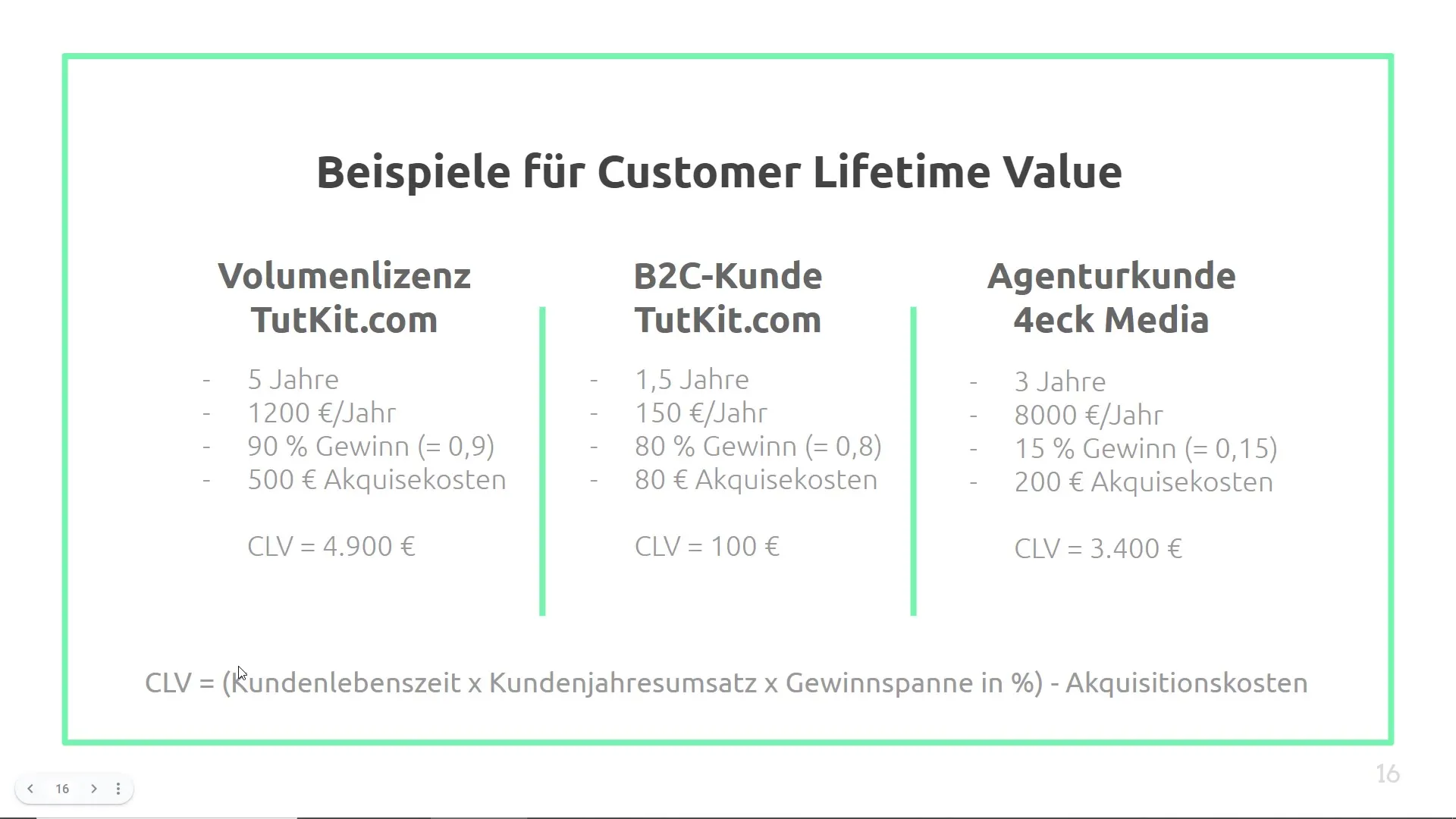

[ CLV = (Customer lifetime \times Annual revenue \times Profit margin) - Acquisition costs ]

Step 3: Examples of CLV Calculation

Let's say you run an E-learning platform. An example of an A-customer could be an educational institution that pays an average of €1,200 per year and has a lifespan of 5 years. The profit margin is 90%, and the acquisition costs are €500.

This shows that this educational institution is an A-customer and represents a valuable source of revenue.

Step 4: Analyzing B and C Customers

On the other hand, a private user with an average membership may pay €150 per year and typically stay for 1.5 years. Assuming the profit margin is 80% and the acquisition costs are €80.

This means that this is a B-customer who brings in less profit and may require less maintenance.

Step 5: Considering Additional Factors

It is important to consider other factors in the analysis. For example, economic trends, discounts, and seasonal changes can influence the actual value of your customers. Customer loyalty and potential referrals should also be incorporated into your considerations.

Step 6: Communication within the Company

All relevant departments in your company should collaborate to evaluate and analyze customer data. Sometimes this requires manual effort, but it is essential to gather the correct data for customer analysis.

Step 7: Implementation and Monitoring

After analyzing your customers, implement measures to better serve your A and B customers. Be sure to regularly calculate the Customer Lifetime Value and adjust your strategy as needed. This allows you to continuously optimize the efficiency of your marketing and sales efforts.

Summary

The ABC customer analysis and the calculation of the Customer Lifetime Value are crucial steps to better understand your customers and address their needs strategically. By precise classification and a clear customer retention strategy, you can ensure the long-term success of your company.

Frequently Asked Questions

What is the ABC customer analysis?The ABC customer analysis categorizes customers into three categories: A, B, and C, based on their revenue contribution.

How is the Customer Lifetime Value calculated?It is calculated by inputting the customer lifespan, the annual revenue per customer, the profit margin, and the acquisition costs into a formula.

Why is it important to calculate the CLV?The CLV helps you understand the value of a customer over the entire relationship period and to develop targeted marketing strategies.

What factors influence the CLV?Factors such as acquisition costs, customer retention costs, economic trends, and discounts can influence the CLV.

How often should the CLV be recalculated?It is recommended to regularly recalculate the CLV to make current analyses and strategic decisions.